[ad_1]

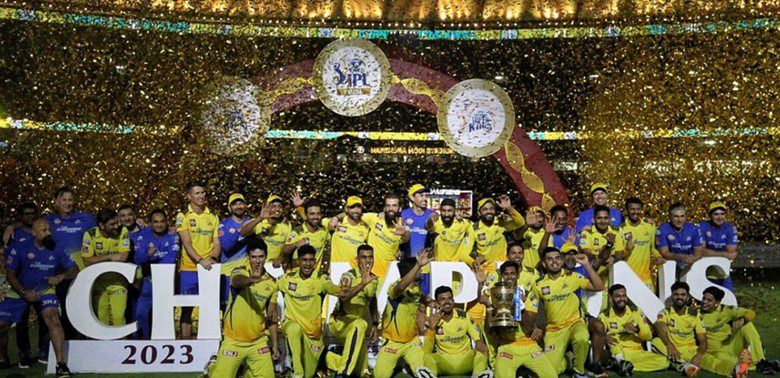

The Indian Premier League (IPL) has proved its mettle but once more as an trade chief, boasting substantial will increase in franchise values in 2023. Main the pack is the Chennai Tremendous Kings (CSK), who clinched the championship in 2023 and now prime the record of name rankings with a hanging valuation of $212 million, a forty five.2% rise from its earlier worth of $146 million in 2022.

Sizzling on CSK’s heels are the Royal Challengers Bangalore (RCB). Though they haven’t but secured an IPL title, RCB’s model worth nonetheless soared, rating second at $195 million, up 52.3% from the earlier yr. In response to the report, this surge might be attributed to the charismatic presence of Indian cricket legend and captain Virat Kohli.

Following intently behind, the five-time champions Mumbai Indians (MI) noticed their model worth improve by 34.8%, regardless of not making the playoffs for 2 consecutive seasons. Now value $190 million, MI is third on the record, holding onto its standing amongst the top-tier groups.

Earlier than we dive additional into the information, let’s check out the highlights of the model worth report.

- CSK Most Invaluable Model with Worth of $212 Million

- Rajasthan Royals Greatest Proportion Change in Worth Yr-Over-Yr at 103.4%

- Gujarat Titans First Model Valuation Stands at $120 Million

Full Checklist of IPL Model Values in 2023

| Franchise | Model Worth 2022 (in USD million) |

Model Worth 2023 (in USD million) |

Change |

|---|---|---|---|

| Chennai Tremendous Kings (CSK) | 146 | 212 | 45.2% |

| Royal Challengers Bangalore (RCB) | 128 | 195 | 52.3% |

| Mumbai Indians (MI) | 141 | 190 | 34.8% |

| Kolkata Knight Riders (KKR) | 122 | 181 | 48.4% |

| Delhi Capitals (DC) | 83 | 133 | 60.2% |

| Sunrisers Hydrabad (SRH) | 81 | 128 | 58.02% |

| Rajasthan Royals (RR) | 59 | 120 | 103.4% |

| Gujarat Titans (GT) | N/A | 120 | N/A |

| Punjab Kings (PBKS) | 63 | 90 | 42.85% |

| Lucknow Tremendous Giants (LSG) | N/A | 83 | N/A |

Media Rights Deal Helps Increase Groups’ Values

The notable surge within the IPL’s total model worth this yr is basically as a result of 2023-2027 media rights mega deal struck with Viacom18 and Disney Star. The profitable public sale introduced forth a big leap in media rights, outperforming even the Nationwide Basketball Affiliation (NBA), English Premier League (EPL), and the Bundesliga, and trailing simply behind the Nationwide Soccer League (NFL) on a per-match foundation.

On this trendy period, the shift in direction of digital platforms for sports activities consumption has taken heart stage. Harsh Talikoti, Senior Vice President, Company Valuation Advisory Providers at Houlihan Lokey, highlighted this phenomenon in his report, “Viacom18’s strategic push in direction of selling digital viewership in India has undeniably reignited the much-needed pleasure surrounding the IPL.”

Rajasthan Royals Model Worth Will increase Over 100% Yr-Over-Yr

Different groups within the IPL have additionally proven promising progress of their model values. The Kolkata Knight Riders (KKR), Shah Rukh Khan-owned franchise, ranks fourth with a price of $181 million. Much more hanging is the Rajasthan Royals (RR), making a big leap of 103.4% in model worth, now value $120 million. In reality, the RR staff demonstrated the very best incremental model worth in share phrases year-on-year.

As for the newcomers to the IPL, the Gujarat Titans (GT) first model valuation was a considerable $120 million, whereas the Lucknow Tremendous Giants (LSG) preliminary worth stands at $83 million.

Massive Groups Drawing Largest Viewership

One other development emerged from the report displaying CSK, RCB, and MI matches drawing peak viewership. Notably, the ultimate match between CSK and GT pulled in a formidable 32.0 million concurrent viewers on the Jio Cinema platform.

The IPL’s income mannequin ensures that each franchise advantages from an equal share of the central pool, comprising media rights and central sponsorships. This mannequin, coupled with the timeless ardour of Indian cricket followers, ensures that the IPL continues to be a beneficial asset, no matter disparities in model values amongst groups.

As these values proceed to climb, we are able to count on an ever-evolving, more and more aggressive IPL panorama sooner or later.

Betting Guides You Might Like

[ad_2]

Source_link