[ad_1]

The growth of Israel’s floor operations in Gaza added extra strain to international markets as buyers put together for a busy week full of main central financial institution choices and a high-stakes announcement of US bond gross sales.

Article content material

(Bloomberg) — The growth of Israel’s floor operations in Gaza added extra strain to international markets as buyers put together for a busy week full of main central financial institution choices and a high-stakes announcement of US bond gross sales.

Center Jap markets that opened on Sunday confirmed little signal of panic a day after Israel despatched troops and tanks into the northern Gaza Strip. Israel’s TA-35 inventory index rose 1.1% as of two p.m. in Tel Aviv, trimming its loss to 11% for the reason that Hamas infiltration on Oct. 7. A clearer indication will come as soon as main currencies and futures begin buying and selling in Australia and Asia within the early afternoon hours within the US.

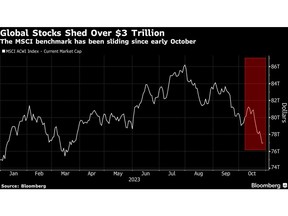

Traditionally, main worth swings are typically short-lived as geopolitical dangers shift. However the risk that the battle finally ends up drawing in nations corresponding to Iran and even the US might ship oil costs hovering and sap buyers’ danger urge for food. The worldwide inventory market has already misplaced $12 trillion in worth for the reason that finish of July as concern mounts that central banks’ “higher-for-longer” interest-rate insurance policies might tip the worldwide financial system towards a recession.

“Markets face a really difficult backdrop at this juncture,” stated Paul de La Baume, funding adviser at BNP Paribas (Suisse) SA. “Geopolitical occasions are including extra volatility and decreasing visibility.”

Israel stated it had hit tons of of Hamas targets, together with missile-launch posts, with Prime Minister Benjamin Netanyahu warning Saturday of a “lengthy and tough” battle.

The Center East provides a few third of the world’s oil. West Texas Intermediate surged as a lot as 3.2% Friday to commerce above $85 a barrel. It stays beneath its highest level for the reason that battle broke out — simply above $90 — as to date there’s been no actual influence on international provides.

“The market has discounted a comparatively average state of affairs, through which the battle is kind of restricted to the realm,” stated Francisco Quintana, head of funding technique at ING Spain. “The strain is sufficient to increase power costs, put strain on inflation, and forestall central banks from stress-free.”

Quintana warned that “the internationalization” of the battle “would place us very near the eventualities of 1973.” That yr, surging oil sank the worldwide financial system after the Arab-Israeli battle trigged members of the Group of Petroleum Exporting Nations (OPEC) imposed an embargo in opposition to the US.

To make certain, Seventies-style stagflation stays a distant risk. Main conflicts involving Israel and Arab neighbors on this century have had no lasting influence on oil, with crude costs unchanged within the first 100 days following the conflicts, based on Marko Papic, chief strategist at Clocktower Group.

The VIX index, generally known as Wall Avenue’s worry gauge, has elevated to 21 from 13 in mid-September, however stay effectively beneath the 27 stage hit in March when the collapse of a number of regional banks set off a market rout.

Secure Havens

Nonetheless, ought to pressure escalate, merchants and strategists stated, safe-haven belongings, corresponding to gold, Swiss franc and short-dated authorities bonds will proceed to learn. Gold has stood out as one of many greatest winner for the reason that battle began, rising nearly 10% to greater than $2,000 an oz.. Commodity currencies, corresponding to Colombian peso and Brazilian actual, have additionally been greatest performing currencies , adopted by the Swiss franc.

The intensified battle within the Center East comes initially of per week with a slew of probably market-moving occasions, together with central financial institution conferences in Japan, US and the UK.

On Wednesday, the US Treasury Division will unveil its quarterly bond gross sales plan, an announcement might decide whether or not the 10-year Treasury yields have the momentum to maintain rising after surging to a 16-year excessive final week. The week will finish with the US payroll report that will present job and wage progress slowed final month.

“If you happen to consider present occasions may have an enduring influence on international societies, your required danger premium will go up,” stated Jeroen Blokland, head of analysis agency True Insights. “Despite the fact that this influence isn’t simply measured, it shouldn’t be neglected. Politics and political currents have gotten extra polarized and extra excessive.”

—With help from Sagarika Jaisinghani, Vinícius Andrade and Elena Popina.

[ad_2]

Postmedia is dedicated to sustaining a vigorous however civil discussion board for dialogue and encourage all readers to share their views on our articles. Feedback might take as much as an hour for moderation earlier than showing on the location. We ask you to maintain your feedback related and respectful. We have now enabled e mail notifications—you’ll now obtain an e mail in case you obtain a reply to your remark, there may be an replace to a remark thread you observe or if a consumer you observe feedback. Go to our Group Tips for extra data and particulars on how you can alter your e mail settings.